Current Status of the Market

April 2, 2025: Tariff Wednesday, Ka Boom!!

First order of business:

We’re sharing this month’s issue of Your Money, Your Moves with you for free. We believe this is a critical time for investors to stay informed, and we want you to see the kind of timely, actionable insights our paying subscribers receive every month.

What in the Sam Hill happened on Wednesday??

What a day for the history books. The day started with a hard move down that occurred overnight and immediately upon opening bell, 0930 EST, the market started pumping upwards. Then at 1400 EST when the President started speaking, the market pumped even harder upwards until he revealed this:

The market was anticipating the same information that had already been spoken about earlier: here a tariff, there a tariff . . . not a tariff for every major trading partner the United States has. The market was caught off guard and is now needing to reprice itself with the potential of a recession sooner than expected if this has major implications on consumer spending.

Reciprocal Tariffs

While writing this, the headline news revealed that China is imposing 34% “reciprocal tariffs.” By definition, “reciprocal” means something done in return. So if we impose reciprocal tariffs, and China responds with their own, and then we retaliate again… are we just stuck in a loop of infinite reciprocity? Confused yet? Welcome to the chaos of a full-blown trade war.

This COULD bring on a recession, depending on how consumers shift their spending habits. If their spending reduces demand, it will reduce corporate revenue, which will also lead to layoffs. Where do we go from here? Difficult to say. . . as Trump will look weak if he backs down from these tariffs. Especially with his tough talk against China, who has been an interesting trading partner since Carter normalized trade relations with them in 1979.

Trump ran on the idea of tariffs and getting trading partners to the negotiating table for better deals. Canada and Mexico are one thing, but China is a completely different animal. They play the 100-year game, and US politics plays the 2-4 year game due to general and mid-term election cycles.

How long will the influencers in the corporate/political sphere who have Trump’s ear be willing to give him before he backs down? We should start a little betting pool as to who blinks first.

Where will the market take us?

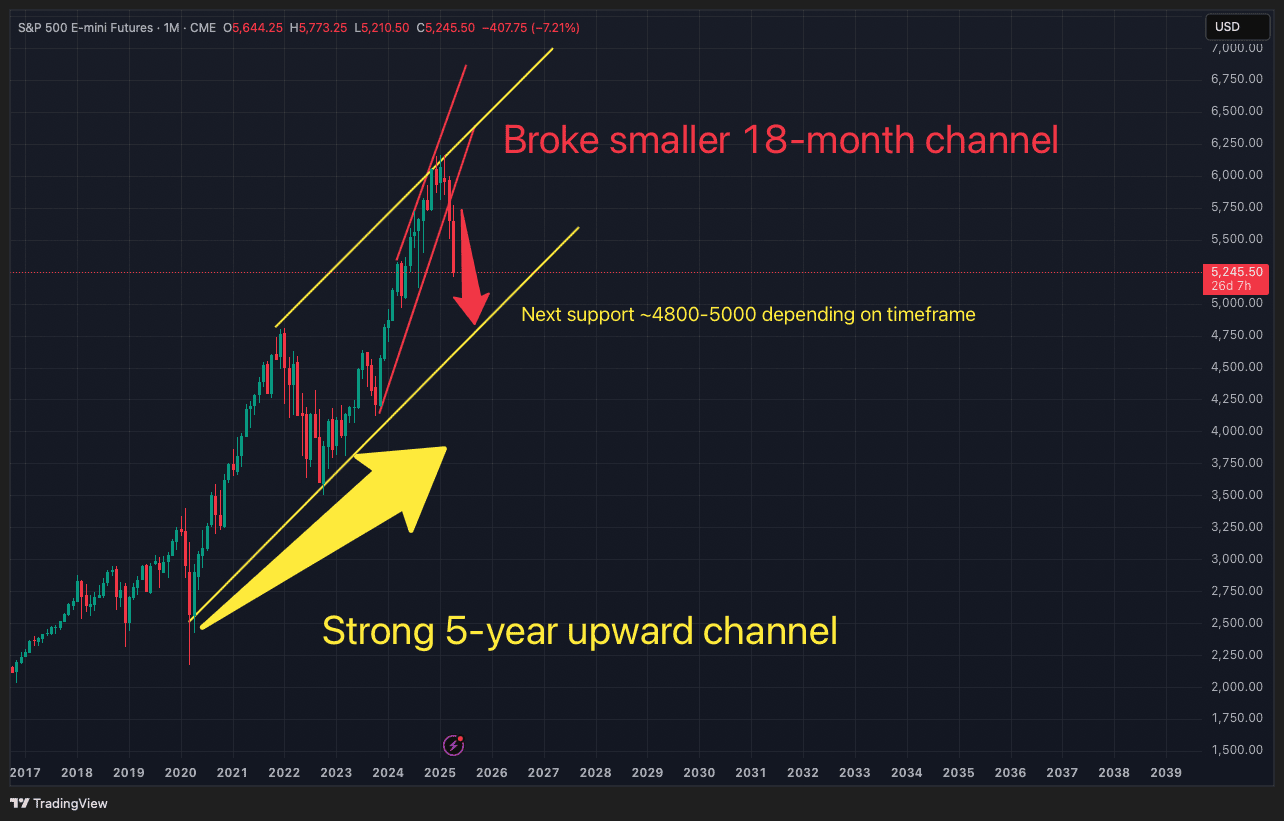

Consider this chart showing two possible market channels:

Yes, we did break a smaller 18-month rising channel that kept pushing the market upwards. However, we have NOT broken a much stronger 5-year rising channel. We haven’t seen the bottom of that channel since mid-2022. It’s due for a touch, and the chance of that is rising by the day. Depending on when/if we get there, the S&P 500 should lie between 4800-5000.

The major question is: what happens if it gets there? A touch of it and a strong move upwards should put to bed this current down move and start building into some sort of recovery.

It is allowed to break it, but not close below it. This means it can touch and then break the channel on a monthly timeframe, but as long as the month closes inside of the channel, we will consider that the bottom, at least for now. Considering the short amount of time of this sell-off, we could be there in relative short order. We do NOT think we are at the bottom currently. It could have some reprieve bounce any time now, but likely, we haven’t seen the lows.

The VIX Number

The VIX measures how much investors expect the stock market to move in the near future. Nicknamed the ‘fear index,’ it signals whether investors are bracing for volatility or feeling confident about stability.

It is calculated by how much people are willing to pay for options premiums. This is where it gets complicated, and we won’t go into the details here, but consider this as a general benchmark:

VIX Number: General Benchmark

< 15 Calm, stable market

15-25 Normal market worry

25-35 Nervous investors or volatile markets

35+ High fear, usually during a market crisis

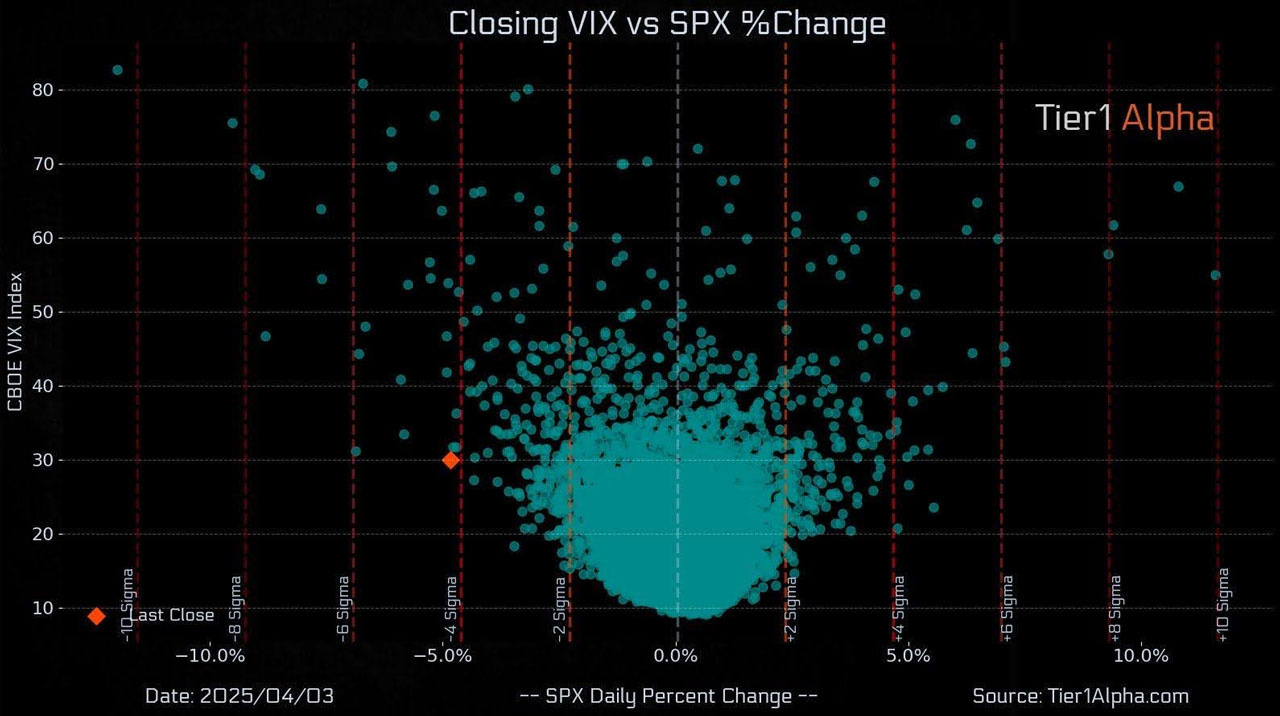

Here is where the VIX is at today:

The VIX was over 40 for a bit there and came back down, and as of this moment, 40.42. We should be in the 60s! We have a bit more down to go in the markets before we find a bottom. The market moved -4.5% yesterday, which is a 4 sigma event, and the VIX did not move 4 sigma to the up.

Now for a bit of a noisy chart:

The orange dot is where the VIX is relative to the S&P 500. That was the lowest VIX movement since 2003 for a 4-sigma event. It should be much higher, which gives credence that we are likely to see the bottom of that strong 5-year channel we referenced earlier.

Play the long game

We do not want to cause panic as investing is for the longer term, and times like this are when you need to take a deep breath and ensure your financial house is in order.

Ensure you have an emergency fund and have a consistent savings plan. Live within your means, and don’t go into debt unless necessary. In other words, live a provident lifestyle. This too shall pass, and we will help you get through this turbulence!

Our Three Model Portfolios

Portfolio Management: How To

Last edition, we discussed the newsletter’s model portfolios that we publish and gave some salient statistics around annual performance along with risk, specifically the Gain Train strategy. This month, we’ll discuss the logistics of how you invest in a strategy, specifically:

A. Fractional Shares

B. Monthly Rebalancing

C. Adding Cash

A. Fractional Shares

Most brokerage houses will let you carry what’s called “fractional shares,” meaning you do not have to buy a rounded number of shares. What you do in this case is calculate a fractional share that you can own.

I.e. for $QQQ $14,000 at today’s closing price would get you 33.12 shares rounded off to the nearest 1/100.

Fidelity will allow you to purchase fractional shares within your brokerage accounts, and they have an intuitive calculator when you open their trade ticket to put in the dollar amount and it automatically calculates how many shares you will purchase.

We are not endorsing any one broker over the other as that is personal preference, but if you want fractional shares, Fidelity is the most versatile, and they trade commission-free.

B. Monthly Rebalancing

When it comes time to rebalance, you will have a different value when it’s time, either more than you put into the investment or less. You will then take the new percentage each month and calculate how much will go into each holding.

Let’s assume the portfolio went up 2% net overall. You would then be working with $102,000 and would run the same allocation on each holding. If you are within 1% of each holding’s weighting, there might not be a need to rebalance that specific position. If you are short a little bit in one position, just adjust the money market position if needed.

C. Adding Cash

If you are adding to your positions each month due to a surplus in your cash flow, you would follow the same rules as #2. Our model portfolios are published monthly, so if there is no change to the strategy, simply take your cash and multiply it against the weighting of each holding and allocate appropriately.

If you are worried about volatility and do not want to allocate for the month, take the month off and let your existing positions ride it out, and if you see a buyable dip, get that excess cash allocated.

We do not recommend trying to time the market, but if it makes you feel better to be a little cash rich from excess income, no problem in that. Remember that dips are investments that go on sale.

Disclaimer

The information provided in this newsletter is for informational and educational purposes only. Your Money, Your Moves is not a registered investment advisor and does not provide personalized financial advice. The content presented should not be construed as investment advice, a recommendation, or an offer to buy or sell any security, product, or financial instrument. All investment strategies and investments involve risk of loss.

You are responsible for your own investment decisions, and we encourage you to consult with a licensed financial advisor or other qualified professionals before making any investment decisions. The opinions expressed in our publications are solely those of the authors and do not represent the opinions or recommendations of any regulated financial institution or investment firm.

Your Money, Your Moves does not have any affiliation with any of the investment holdings within our model portfolios, and we do not receive compensation or benefits from any companies, funds, or products that may be mentioned or featured in our content.

We disclaim any liability for any loss or damage caused by reliance on the information contained in this newsletter. Past performance is not indicative of future results.